Mandatory documents required for filing ITR

One must file ITR every year. It is mandatory for obtaining loan, applying for visa, get your TDS refund, claim deductions and to avail many more benefits. Here are some documents that should be ready to hand for the purpose of filing ITR.

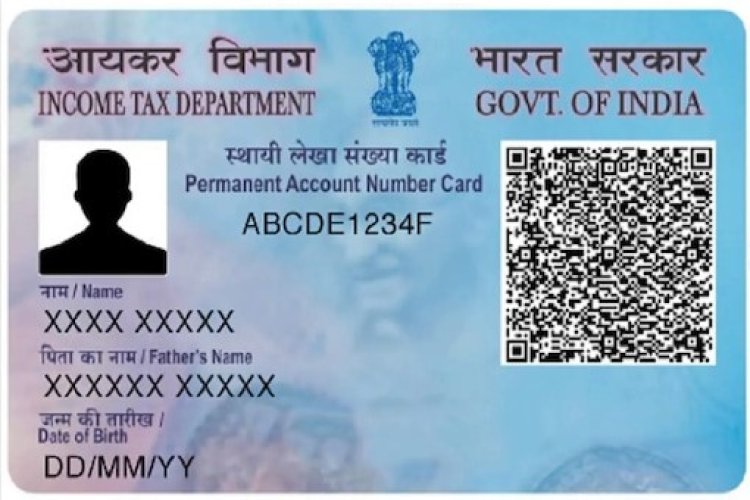

1. PAN Card

The primary document for filing your Income Tax Return is PAN Card. It is a 10 digit’s alphanumeric number. You can apply your Pan Card through the site NSDL. Your PAN Card is also your username at Income Tax Portal.

2. Aadhaar Card

It is a 12-digit number known as an identity number of an individual. You can apply for your Aadhaar Card through Aadhaar Seva Kendra of your area. Government has set up over 35000 Aadhaar Seva Kendra all over India.

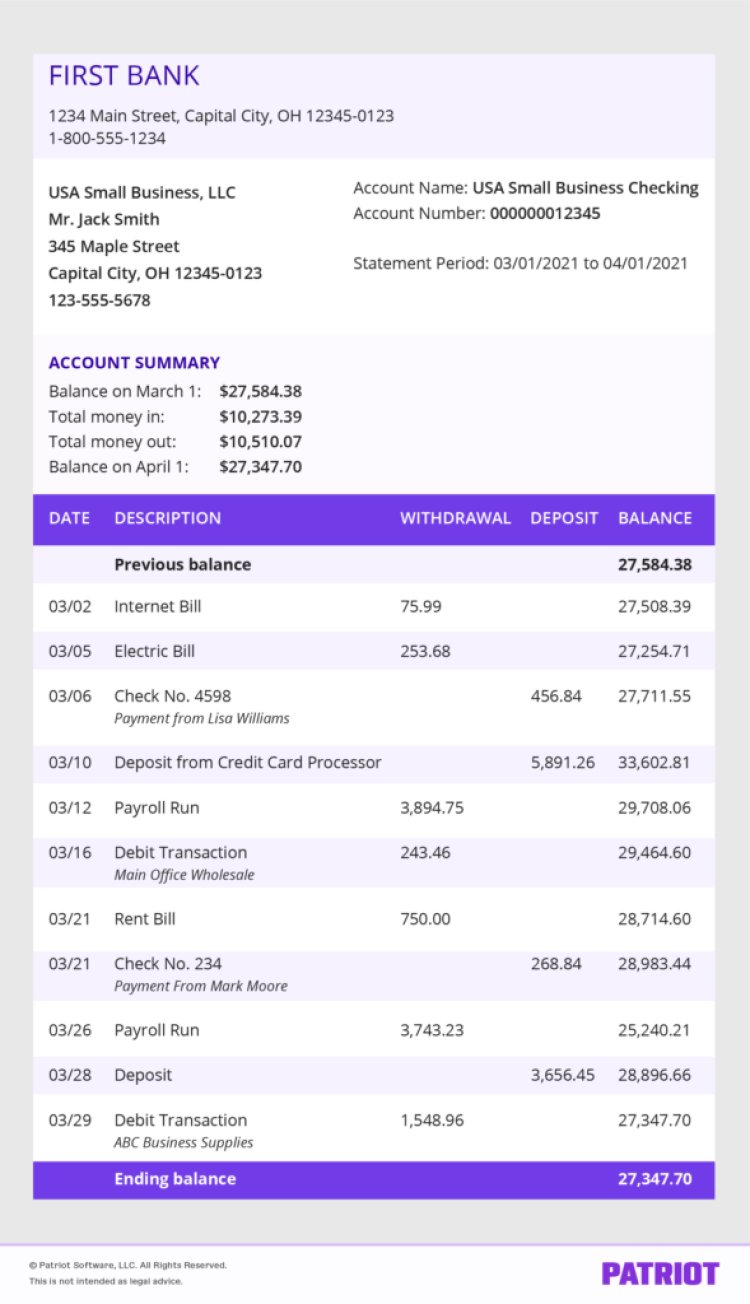

3. Bank Account Statement

Bank account statement is the most important to verify the transactions of an individual. Limits of cash deposits and withdrawals must be followed as per the prescribed rules and regulations.

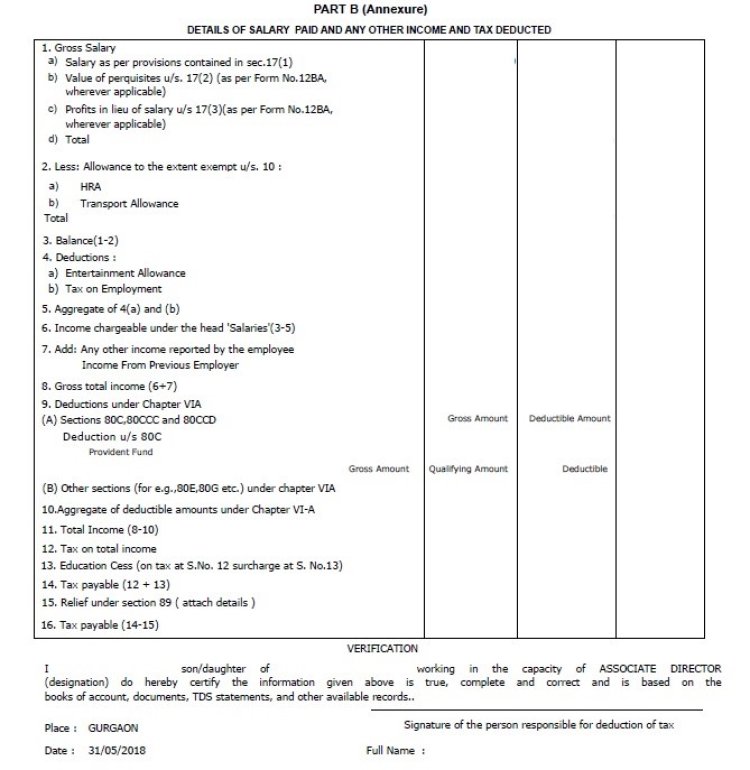

4. Form-16

This form is mandatory for the salaried individuals. Form-16 contains the details of Salary, DA, Bonus, Allowances and Deductions in a brief way which is useful for filing ITR. TAN, PAN, address of the employer and related miscellaneous details are also available in this form which are required for the purpose of filing Income Tax Return.

5. Tax Saving Instruments

There are many taxes saving instruments which are helpful in reducing your current tax of the year. Some of them are like: ELSS (mutual funds especially with tax saving benefit schemes), Life Insurance Policy, Housing Loan, Donations, House Rent, Medical Policies, Disability proofs and medical expenditures. Proofs for such deductions either in form of statements or certificates must be handily available with the tax payer to file ITR and claim deductions for the same.

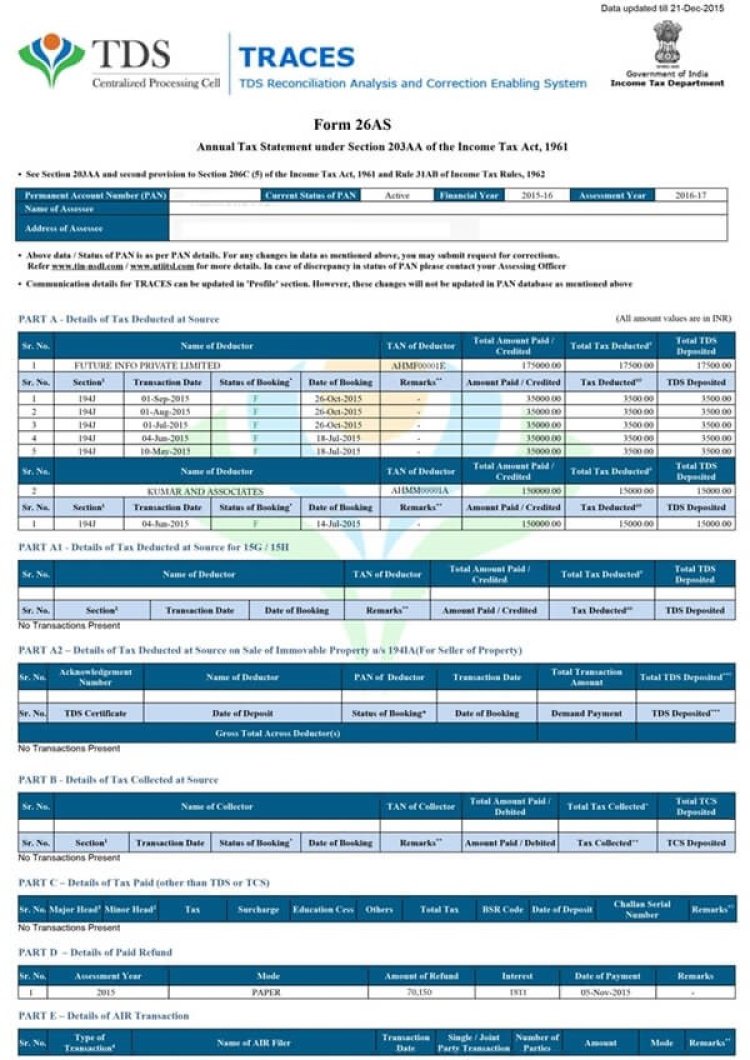

6. Form 26AS

This is the form which contains the details like TDS, interest on income tax refund, TCS details etc. In short it provides the details of those income on which TDS is deducted and expenditures incurred on which TCS is paid.

7. Capital Gains Details

In case of any property being sold one must pay tax on the profit generated on account of such sale. Evidences for the same including the stamp duty paid must be submitted for the purpose of filing ITR.

8. Share Trading/ Mutual fund

These investment tools are becoming common these days to invest. One must provide the details in case of any sale of shares or mutual fund units in their return. Tax must be paid in case of any profits while the losses can be carried forward and claimed as deduction for tax purposes.

9. Other Sources of Income

An individual is required to give details of incomes generated from other sources. Other sources are the head that covers the incomes that does not form part of the heads- salary, house property, business & profession and capital gain. It includes incomes like- Dividend income, Saving interest, FDR interest, PPF interest etc.

10. Director/ Partner Details

Any individual who is a director or a partner in any entity is required to submit the details like: DIN, CIN of the entity along with its name, profit share in firm or shares of the entity and any income being generated from such firm or entity along with evidence for the same.

What's Your Reaction?